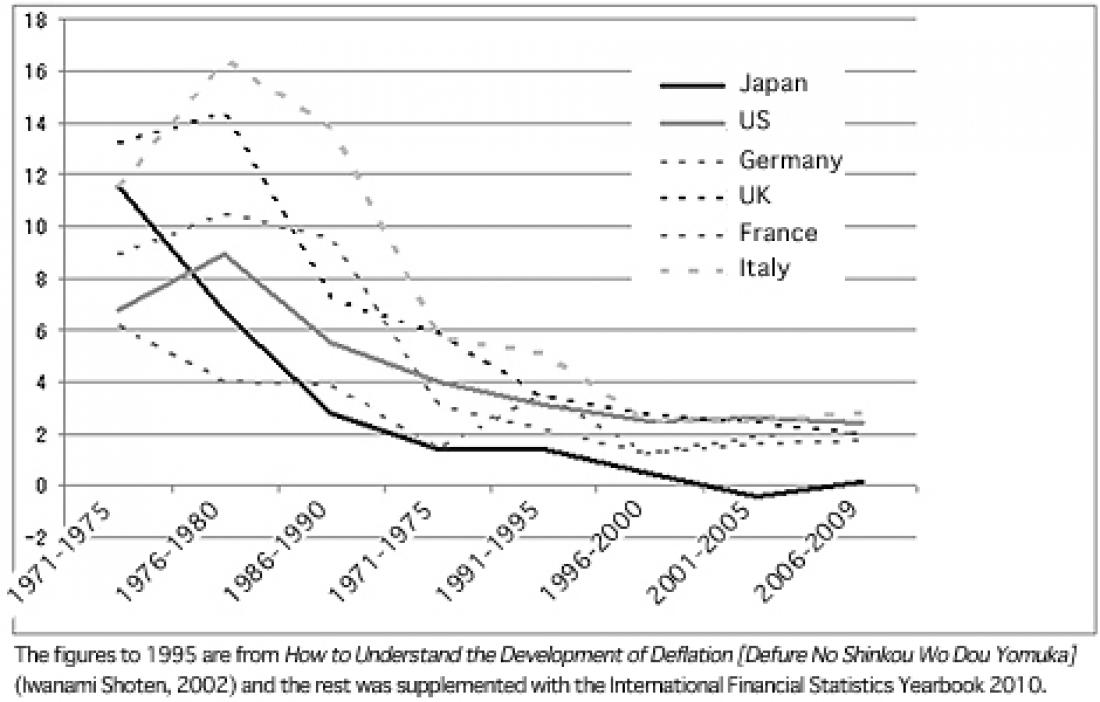

Figure 1: Rates of CPI increase in developed countries after the oil crisis

Lowering and raising interest rates according to prices and the economic situation is basic monetary policy. As the supply of money, that is, liquidity increases steadily in response to a serious economic recession, however interest rates will soon reach the lower limit of zero, and monetary policy will lose its effect. This is the situation that Keynes termed a "liquidity trap" in the great depression period in the past, which is being reproduced in Japan, the United States, and Europe today. The troubles of the so-called developed countries are more serious than ever. Is there any effective measure to be taken for a trapped monetary policy?

IS THE INFLATION TARGET USEFUL?

The appropriate level of the interest rates to be realized in monetary policy depends on the level of long-term inflationary expectations as well as economic fundamentals and people’s economic outlook. So, how about this—the central bank publicizes an inflation rates as its policy goal and commits itself to realizing such rate. If people have appropriate inflationary expectations, the risk of monetary policy collapsing into functional failure can be decreased. This is the policy measure known as an inflation target. However, the feasibility of such a measure should be evaluated according to time and circumstances.

Figure 1 shows how inflation in developed countries cooled down simultaneously during the thirty years or so after having surged as a result of the significant events of the oil crisis and the shift to a floating rate system in the 1970s. In the background, of course, there have been efforts and policy coordination among the countries. I wonder, however, with that alone, if the rates have moved closely together in that way. It is unreasonable, because, given the various circumstances of those countries then and now, without support by the great force beyond the individual efforts of policy makers, the countries could not have had disinflation or deflation all at once in such a magnificent way as this.

What would this force be? It is the force of the markets. Supported by the innovation of information and communication that progressed suddenly in this period, the force of global price competition collapsed the cost buildup price formation mechanism that had prevailed in the past. It ended the period of inflation. It is the force of the markets and not policies that have changed the world.

If you recognize this, you can understand why many central banks in the world are cautious about introducing this policy measure, as they are taken aback by the fear of deflation. As with any policy, the time and circumstances are important. Apart from the times when the fight against inflation as a domestic issue was the main role of the central bank, in the current world and the great tide of global price competition, the tide of deflation cannot be reversed to inflation by the mere fact that the central bank commits to its inflation target. In such a situation, more efforts are required to convince people about what the central bank says. Thus, it is the methodology known as the forward guidance for monetary policy to attract attention.

LIMITATIONS OF THE FORWARD GUIDANCE OF MONETARY POLICY

The forward guidance for monetary policy is the generic term for policies to break the deadlock, when the effects of the financial policy measures on hand are limited at present, by committing to its policies in the future in the market.

Let us consider the following policy, for example. When interest rates reach the lower limit of zero, the central bank commits to keeping the rates at zero by all means in the next year or after in the future. In such a case, the companies and the families that hold off investment because the situation is too bad even at a zero interest rate, may resume investment assuming that long-term low interest rates will be committed. That is the advance of the policy effect.

The forward guidance for monetary policy is evaluated as having been effective to some extent introduced in a Japan troubled with serious deflation in the 2000s. The United States is now adopting a similar policy measure. In the Federal Open Market Committee (FOMC) on August 9, 2011, the U.S. Federal Reserve Board (FRB) declared that it "would keep the current ultra-low interest rate policy at least until the middle of 2013." That is also a kind of forward guidance for monetary policy. In the current situation, policy makers are so cornered that they depend on such advance policy.

We should not expect much from this policy measure, however. For the function of such forward guidance for monetary policy, we need to believe in the great richness of the future that can realize the advance effect of the policy. The problem is whether it is truly possible.

THINKING IN THE BROAD CONTEXT OF HISTORY

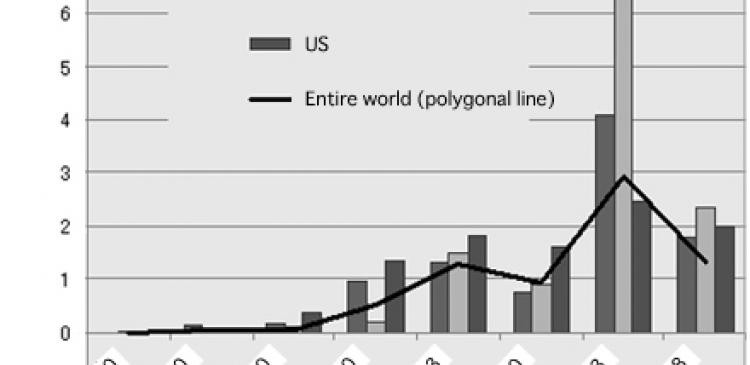

Figure 2 (below) shows the growth rates of the world economy over the ultra-long span of approximately 2000 years. The figure shows that the growth of the economy measured in GDP per capita, the richness of the people, is only a page of the human economic history, which began approximately 200 years ago.

We cannot overlook this point in considering the problems of the modern currency, which developed from the gold standard of the 19th century, as well as the problem of the declining birthrate or the energy problems including nuclear power generations in the future.

The history of the modern currency system, in brief, coincides with the history of economic growth. If you recognize this, you can understand that what we need to bear in mind is that it remains to be seen whether the currency system will function in the future in the same way as in the past, and the superficial policy techniques such as an inflation target and the forward guidance for monetary policy may not be effective. The situation that the world is currently falling into is not a cyclical crisis that can be described as an economic boom or economic downturn, but rather it may be a sign that the modern monetary system subject to economic growth is collapsing in substantive functional failure.

This is not to say, of course, that we should resign ourselves to pessimism unnecessarily. Problems may be solved, for example, by introducing electronic devices into the current monetary system that is centered on paper money. (I have no room to elaborate on this point here, so readers who are interested should refer to the Evolution Theory of Money and other publications below.) If, in the first place, we just act under the recognition that the current world is seriously restricted, we can decrease the risk that fear of deflation will cause further deflation—the so-called deflationary spiral. What is important now is to consider the essence of the problem in the broad context of history calmly.

© Mitsuru Iwamura

Professor, Research Institute of the Faculty of Commerce, Waseda University

----

Professor Iwamura was born in Tokyo in 1950.

He graduated from the Faculty of Economics, the University of Tokyo in 1974.

He entered the Bank of Japan in 1974. After working as a representative in New York, Head of Studies Division II of the Institute for Monetary and Economic Studies, and Associate Director-General of the Planning Division/Financial System Division, he became a Professor at the Graduate School of Asia-Pacific Studies, Waseda University in 1998.

He became a Professor at the Research Institute of the Faculty of Commerce, Waseda University (current). He is a Doctor at Waseda University.

His specialization is economics (financial science).

His major publications include:

Evolution Theory of Money [Kahei Shinkaron] (Shinchosha, 2010), Economics of Money [Kahei No Keizaigaku] (Shueisha, 2008), Lecture of Corporate Finance [Kigyo Kinyu Kogi] (Toyo Keizai, 2005), New Price Theory [Atarashii Bukka Riron] (co-authored, Iwanami Shoten, 2004), Study of Electronics General Meeting of Shareholders [Denshi Kabunushi Sokai No Kenkyu] (Koubundou, 2003), Theory and Law of Corporate Finance [Kigyo Kinyu No Riron To Hou] (co-authored, Toyo Keizai, 2001), Cyber Economy [Cyber Economy] (Toyo Keizai, 2000), Introduction to E-Money [Denshi Manei Nyumon] (Nikkei, 1996), Bank Management Innovation [Ginko No Keiei Kakushin] (Toyo Keizai, 1995), Introduction to Corporate Finance Theory [Nyumon Kigyo Kinyuron] (Nikkei, 1994)