By David Turner

SMU Office of Research – It is a universally acknowledged truth that companies in pursuit of profit often want to avoid paying taxes. Few things affect the economy and how business is done as profoundly as company behaviour in relation to tax. Yet little is known about how companies conduct their tax affairs, which are largely kept out of the public eye.

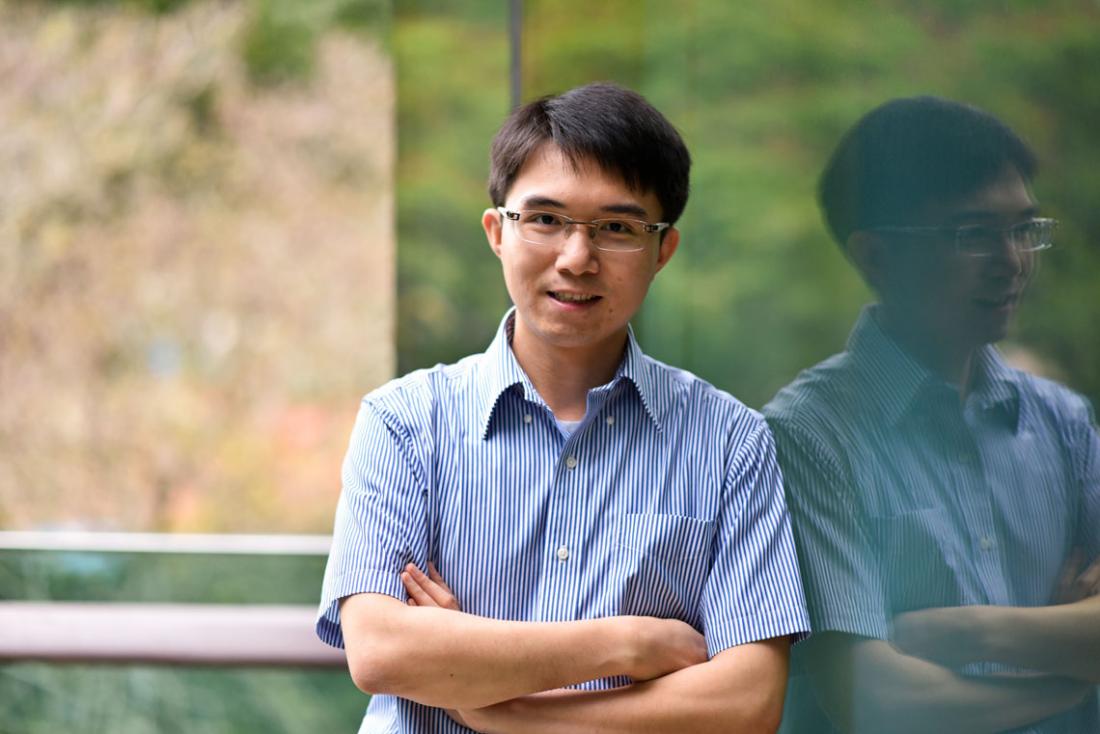

Unlocking the black box of corporate tax departments is a key research area for Travis Chow, Assistant Professor of Accounting at the Singapore Management University (SMU) School of Accountancy. His research aims to shed light on companies’ tax lives, such as how the way they invest in tax planning might affect shareholder value and tax efficiency.

“Taxes have huge implications for businesses, especially in high tax countries such as the US and Canada, where taxes can be as much as 30 to 40 percent of corporate profits,” says Professor Chow.

But not so well appreciated is how pervasively tax influences company decisions. “Companies make big decisions based on the tax implications – from the location of the headquarters and subsidiaries, capital structure, and organisation form, to investment decisions such as mergers and acquisitions,” he explains.

As well as the significant implications for companies and shareholders, these decisions ultimately affect the economy as a whole, as governments strive to design efficient tax systems.

Despite this importance, Professor Chow says that public information about company tax behaviour is scarce. In the US, he notes, only the Internal Revenue Service sees the tax returns, which are recorded separately from those publicly available financial reports prepared according to US GAAP (Generally Accepted Accounting Principles). Public financial reports also do not say how much of companies’ resources are devoted to the tax departments which are responsible for tax planning.

Studying tax planning from human resource decisions

Professor Chow and his colleagues at SMU have therefore had to devise novel ways of obtaining data to look deeper into the mystery of company tax departments.

“Because public information about companies’ tax affairs is very restricted, we look for more interesting data. Human capital is one area where new information is entering the public domain,” said Professor Chow. Using LinkedIn, an online professional network, his research team collected data about the education and experience of employees in tax departments from a sample of 1,500 S&P (Standard and Poor’s) firms.

Professor Chow found that firms that invest heavily in their own in-house tax departments tend to be larger, incur less debt, have more intensive research and development programmes, and have more diverse geographical and business segments.

More significant were Professor Chow’s findings in the second limb of his research: larger in-house tax departments were associated with more aggressive tax planning yet less uncertainty, as evidenced through lower effective tax rates, lower cash tax paid, lower reported uncertain tax benefits, and less volatile tax rates. “They want to avoid paying more tax. At the same time, they also want more certainty – the more people they employ, the more confident they are that the tax authorities will not overturn their tax positions,” he adds.

Is tax planning ultimately value creating or destroying?

In addition to unlocking the mystery of corporate in-house tax departments, examining the implications of aggressive tax planning in mergers and acquisitions (M&A) is another major agenda of Professor Chow’s current research. One of his working papers in this area, based on US merger and acquisition data from 1990 through 2010, posits that tax planning is potentially an important factor, as shareholders consider future tax planning changes as one of the major factors in valuing M&A transactions.

“Prior evidence says that shareholders see aggressive tax planning as a positive attribute because they can foresee that they will pay less tax. But a M&A situation is more complicated, because the firms coming together have different tax planning capabilities and different levels of aggression in planning their tax,” he explains.

Again, Professor Chow needed to exercise some ingenuity to find data, given the secrecy which surrounds companies’ tax efforts. “For our M&A research, we also examined tax information given in filings to the US Securities and Exchange Commission, via the Form 8-K, in which companies may reveal little traces of information regarding how they have planned their taxes - information that was not otherwise available in the public domain.”

The results of this research again highlighted the wider significance of the way a company invests in tax planning. “The research found that shareholders reacted negatively when the acquirer had poor tax planning abilities. Even if the target was good at tax planning, they believed that the target’s tax efficiency would get worse because the new acquirer did not care about tax planning.”

A collective effort

The field of M&A is a perfect example of Professor Chow’s belief that a multidisciplinary approach to tax research is very important. “Tax research is one of the most multidisciplinary subjects in social science, because it involves law, finance, economics and public policy – it is definitely not just for accountants,” he says.

“In places like the US, where taxes are very high, companies spend a lot of resources on tax planning and do many things to avoid these taxes. It is a lose-lose situation and it is not sustainable. It would be very interesting if governments can improve their ability to take into account how companies will respond to taxes,” he added.

Professor Chow also believes that a clearer understanding of the behaviour of companies in relation to tax would help governments achieve a more efficient tax system and improve corporate productivity.