TOWARD INCLUSIVE GROWTH

Liberalization of the economy and the promotion of trade have been and still are among the main objectives of South Africa and other Sub-Saharan countries’ policy makers over the past decades. At the global level, trade’s share of gross domestic product (GDP) has increased constantly since the 1980s, and in Sub-Saharan Africa, the share has recently exceeded 60%.[i]

Increasing exports has a number of potential benefits including earning foreign currency to pay for imports, achieving economies of scale, the possibility of “learning-by-exporting,” an increase in productivity, and the possible entry of new firms that can create jobs. One of the main questions that remain is whether exporting can create jobs for the poor. Which types of industry, firm, or destination should be promoted to achieve this policy objective? This One-pager discusses one of these factors: namely, what type of export destination is associated with better jobs for the poor?

Not all exporting has the same impact on labour demand —export destination should matter for trade promotion policies designed to reduce unemployment.

THE EVIDENCE

A GGP-supported research project investigated the linkages between export behaviour, jobs, and wages in South Africa and other Southern African Development Community (SADC) countries.[ii] Trade literature has already highlighted the wage premium paid by exporting firms. Most recent studies found that higher wages are related to export intensity and destination. This hypothesis suggests that firms exporting to richer countries attract a higher quality workforce and pay higher wages.

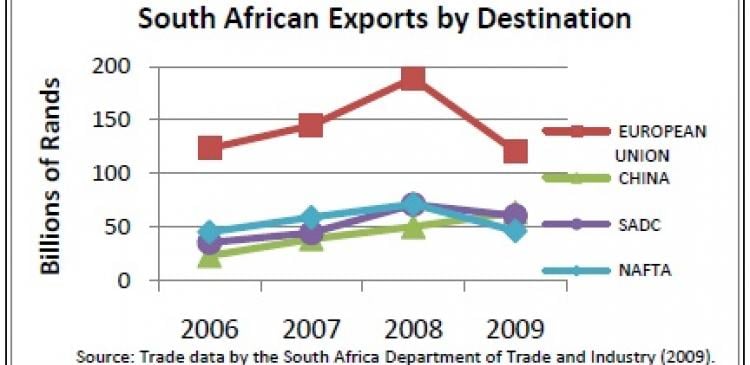

South Africa is an interesting case study since it has two clearly distinct export markets: other SADC countries, where per capita incomes are low, and the European Union and the United States, where per capita incomes are the world’s highest (see figure). The research hypothesis was that South Africa would export high-price (and thus high-quality) products overseas but low-price (and low-quality) products to other SADC countries. Workers in firms that export to destinations with high per-capita incomes (consuming better quality goods) would earn more. The research confirmed that exporting has an impact on wages. The researchers found that workers in South African firms that export earn on average 21% more than workers in non-exporting firms.

When it comes to wages, not only does exporting matter, but the export destination also matters: wages are higher in firms that export outside the SADC region compared to exporting to other SADC countries. Their estimates show that South African firms that export to the rest of the world pay higher wages than firms that supply the domestic market, while exporters to the SADC region pay lower wages. They also found similar evidence in four other SADC countries—Botswana, Namibia, Swaziland, and Zambia—where workers in firms that export outside the region earn more. However, in these countries, workers in firms that export within SADC earn similar amounts to those producing only for the domestic market.

KEY CHOICES

Increased private sector development and export growth must be components of any growth strategy that seeks to address the high levels of unemployment and low wages among an unskilled labour force.

For SADC, the common external tariff and transport costs protect South African firms from international competition. The current SADC trade context is beneficial to South African firms that produce lower quality goods and to low-skilled South African workers who are employed in these firms. Higher wages for South African workers will stem from further penetration of South Africa into the wealthy OECD markets.

Also, given the difference in quality of products destined for SADC countries and other international markets, it is unlikely that SADC could be used as a means of access for South African products to international export markets. However, SADC represents an opportunity for firms in other SADC countries to tap SADC markets. This would help them to survive South African competition in this regional market and thereby generate more low-skilled employment in their economies.

Notes:

[i] International Labour Organization, Global Wage Report 2008 / 09.

[ii] The note draws on research from Project #104443, “Improving Labour Market Outcomes for the Poor in Sub-Saharan Africa: Ghana, Madagascar, South Africa, and Tanzania.” The findings are summarized in “Export destination, product quality and wages in a middle-income country. The case of South Africa” by Neil Rankin and Volker Schöer (2009).