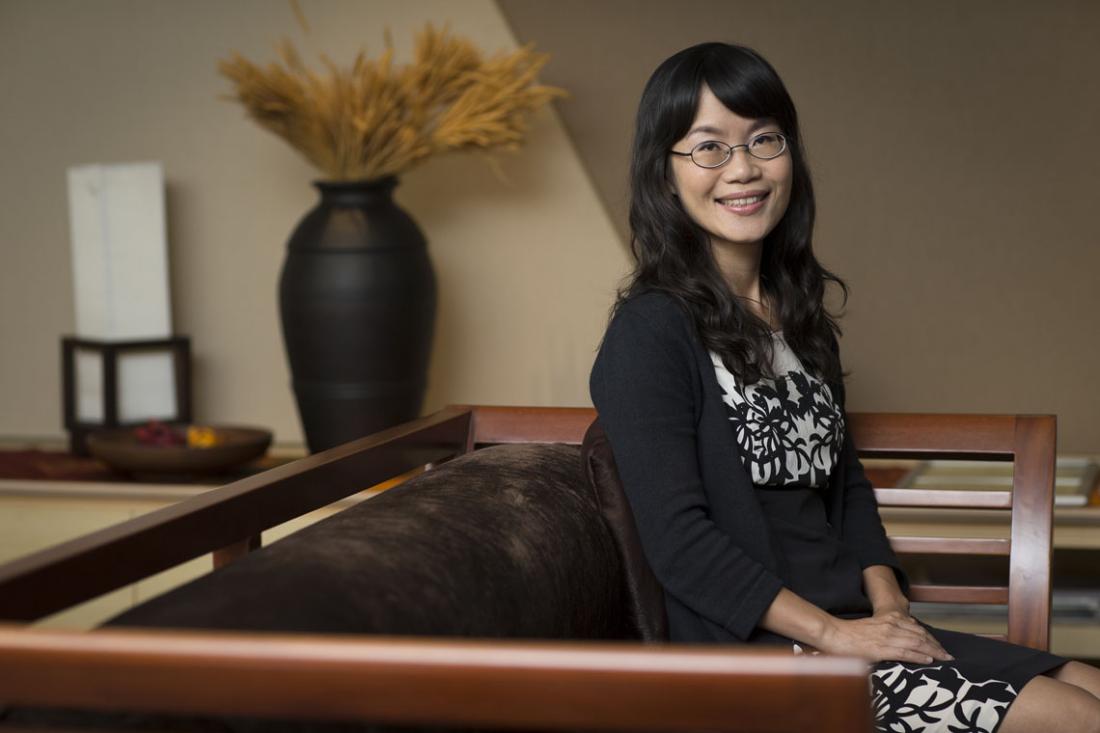

SMU Office of Research – In 2006, Associate Professor Wang Rong was just finishing her PhD in Finance at Washington University in St Louis, US. That year, she published her first yet most cited paper, “Corporate Financial Policy and the Value of Cash”. Up until that point, much research had already been done on how companies financed their overall operations and growth. Having observed that there were relatively few studies on the value shareholders place on firms’ cash holdings, she set out to examine this. “My paper investigated the cost-benefit tradeoffs for holding cash in a firm,” she says.

“Cash holdings are very important for firms. Without cash holdings, a firm won’t be able to maintain its regular operations. Therefore, having the minimal amount of cash for maintaining normal operations is critical to firms. However, if a firm holds more cash than what is required for its operating and investment needs, there is a higher probability of fund wastage. In this case, extra cash holdings become a liability to shareholders,” she explains.

The value of company cash holdings

Together with a colleague from Washington University, Professor Wang then developed a methodology that used stock market returns to measure how shareholders valued changes in firms’ cash holdings. Generally, it would suggest that shareholders were in favour of cash holdings when stock prices responded positively to the increase in cash holdings, whereas smaller movements in stock prices implied that shareholders tend to place less value on increase in cash holdings.

Their study also revealed that shareholders did not value cash holdings in firms that held too much cash. On the other hand, shareholders valued more cash holdings in firms that had difficulty raising money in capital markets. The value of a dollar held by a firm thus decreased or increased accordingly. According to Professor Wang, this methodology has since been widely used by other researchers. The same methodology can also be used to examine changes made by firms related to a variety of other financial policies.

One year after finishing her PhD, she was appointed Assistant Professor of Finance at SMU’s Lee Kong Chian School of Business. “SMU provides extensive research support in terms of dataset subscriptions and conference travel,” she says. “My fellow colleagues and I are privileged to be able to invite top researchers to exchange research ideas and comment on our projects.”

Since her appointment at SMU, Professor Wang has published several more top-tier research papers. In 2008, she won the Best Paper Award at the Asia-Pacific Financial Market Conference.

Gauging the expertise of financial analysts

In 2012, she collaborated with counterparts in the US to conduct a novel study, which received much attention from practitioners. Titled “Analysts' Industry Expertise”, the study compared the across-industry expertise to within-industry expertise of financial analysts. The former referred to the analysts’ ability to rank industries relative to each other, whereas the latter referred to their ability to rank firms within a single industry.

“Prior to this, there was no paper which examined the across-industry expertise of analysts,” says Professor Wang.

The research team explored industry recommendation data available on the Institutional Brokers’ Estimate System, which gathered estimates made by stock analysts on the future earnings of the majority of US publicly traded companies.

Professor Wang explains that analysts evaluate an industry using a bottom-up and/or a top-down approach. In the bottom-up approach, they collect information from different firms in an industry and then aggregate and analyse that information to look for common trends in the industry. In the top-down approach, their strategies for recommending the movement of investments from one sector of the economy to another are mostly driven by the sensitivities of different industries to macroeconomic shocks.

“Our research was mooted from the investors’ perspective,” shares Professor Wang. “We found that analysts had across-industry expertise and investors should listen to analysts’ opinions on industries. Investors should take into account both industry recommendations and firm recommendations when making investments,” she says.

Intangible capital and the global economy

Professor Wang’s current focus is on investigating why capital expenditure of US firms decreased by more than half from 1980 to 2012. A fundamental driver of economic growth, capital investment is critical for firms to survive and grow. Professor Wang and her colleagues from SMU’s Lee Kong Chian School of Business are interested to know whether declines in capital expenditure correlate with declines in investment opportunities and cash flows, or whether such declines only happen to certain kinds of firms.

So far, their findings reveal that the decline was pervasive across industries and firms of different characteristics. “We think the decline was related to the increasing importance of technology, intangible capital and economic globalisation, which had changed the process of firm production,” she observes. Intangible capital includes human capital, organisational capital and patents, for example. It is more difficult to place a value on intangible capital than on fixed assets, she explains.

Firms used to respond to investment opportunities by investing in fixed assets. Nowadays, they tend to invest more in intangible capital such as organisational capital and human capital. A good example of this is how some firms are increasing their expenditure on research and development. Professor Wang and her colleagues discover that intangible capital is significantly related to firm investment levels. Globally, firms in economies with development levels similar to the US tend to show declines in capital investment and rises in investments in intangible capital. Firms in fast-growing emerging economies, on the other hand, continue to focus more on capital investment.

These findings are important because they help researchers understand corporate investment behaviour. “The theory of investment has mainly focused on investments in fixed assets. Our results suggest that it is important to take into account investments in intangible capital as well,” notes Professor Wang. “The economic growth model has changed, and so has corporate investment behaviour. In the past, firms relied more on fixed assets for growth. But in recent years, investments in human capital and technology have become more crucial to the success of firms.”

Fuelled by her interest in issues related to managing corporations, Professor Wang chooses corporate finance as her primary research specialisation. “There are so many questions we can study in this area that are closely related to real life. My main areas of interest are related to firms’ financing and investment decisions,” she says. “I would like to engage in multi-disciplinary research activities with fellow SMU colleagues who specialise in accounting and management. This will enable me to address finance-related issues from a new perspective,” she says.

By Nadia El-Awady